Experimentation era begins as networks ally, Amazon goes local

Nearly a year after Diamond Sports Group declared bankruptcy and an uncertain future for televised sports got even murkier, there remain a great number of questions to be answered.

Where will we watch? Who’ll own the content? How will the economics work?

But the effort by media giants and pro sports leagues to arrive at answers is accelerating. There were significant developments in early February that could have far-reaching implications for how we consume sports.

On Feb. 6, Disney, Fox Corporation, and Warner Bros. Discovery announced they’ll collaborate on a sports app for U.S. consumers, priced somewhere between $40 and $50 per month, which they hope to launch this fall. The alliance is a notable pivot in two ways: it marks the most robust move to date of traditional media companies placing their live sports rights on a streaming platform. And after so much unbundling in the cable universe initiated its downfall, major players have decided to try re-bundling in the streaming space.

A day later, Disney announced it also plans to launch a standalone ESPN streaming app in 2025. ESPN remains the largest rightsholder of live sports content. Although ESPN+ already exists, it broadcasts only a limited amount of live sports, like the NHL out-of-market package in the U.S.

The ESPN standalone app and the ESPN/Fox/WBD offering will broadcast all the live sports content those companies own – and they own the majority of live, national-level sports rights available in the U.S.

The news follows the recent earnings reports of Comcast and Charter, the two largest cable distributors in the U.S., who lost more than three million combined subscribers in 2023. That brings the total decline of cable in the U.S. to date to around 40 million lost subs since 2010, a rate of 40%. Media companies and pro sports leagues can no longer afford to be in denial about the changes in consumer behavior.

“We are entering a more serious experimental phase of this transition from cable to streaming,” Greg Bouris, the director of the undergraduate sports management program at Adelphi University, said. “It looks like ESPN is trying every aspect of it. They have the early entry of ESPN+, which piggybacked off Disney+, which is kind of overflow content. Now they are going to collaborate. It seems like they have their fingers in a few of these pies, which leads me to believe if there was one they felt was the future, they would probably be in that.”

The dual early February announcements are largely tied to high-viewership, national broadcasts like the NFL and college football, and the NCAA’s March Madness basketball tournaments.

Meanwhile, Diamond Sports, the largest regional sports broadcaster, is conducting its own experiment in an attempt to survive. It was back in bankruptcy court Friday to have parts of its new plan approved.

After declaring bankruptcy last March and seemingly on a path to liquidating assets and being out of business by the end of 2024, Diamond announced it reached an agreement on a rescue package last month that included a $115 million cash infusion from Amazon. The tech giant will take a 15% ownership stake in the company and broadcast Diamond RSNs on its Prime Video platform.

Diamond also got approval Friday from the judge overseeing the case in Texas for three new agreements for this season with the Texas Rangers, Minnesota Twins, and Cleveland Guardians.

While industry executives who spoke with theScore have doubts about the viability of Diamond’s ability to survive, the plan will at least buy it more time.

What does this all mean? The quest to find solutions is becoming more urgent, so experimentation is accelerating. There are lots of questions, and developments are changing all the time.

Re-bundling while threading a needle

Perhaps the one big lesson from the week is that the death of the bundle might have been greatly exaggerated.

“I think the consumer is calling for a collaboration, another word for the bundle,” said Bouris, who worked for an early regional sports network, SportsChannel, as well as for pro teams and the Major League Baseball Players Association before joining academia. “For all its gripes over the years with how we purchase cable television, and not having choices, there’s something to be said for having it in the streaming world, and how it functions.”

The announcement of the ESPN-Fox-WBD agreement came this week before financial quarterly reporting for Fox and Disney. Anticipating those calls were analysts with questions about how these legacy media giants will transition into the future without decimating their still profitable cable businesses.

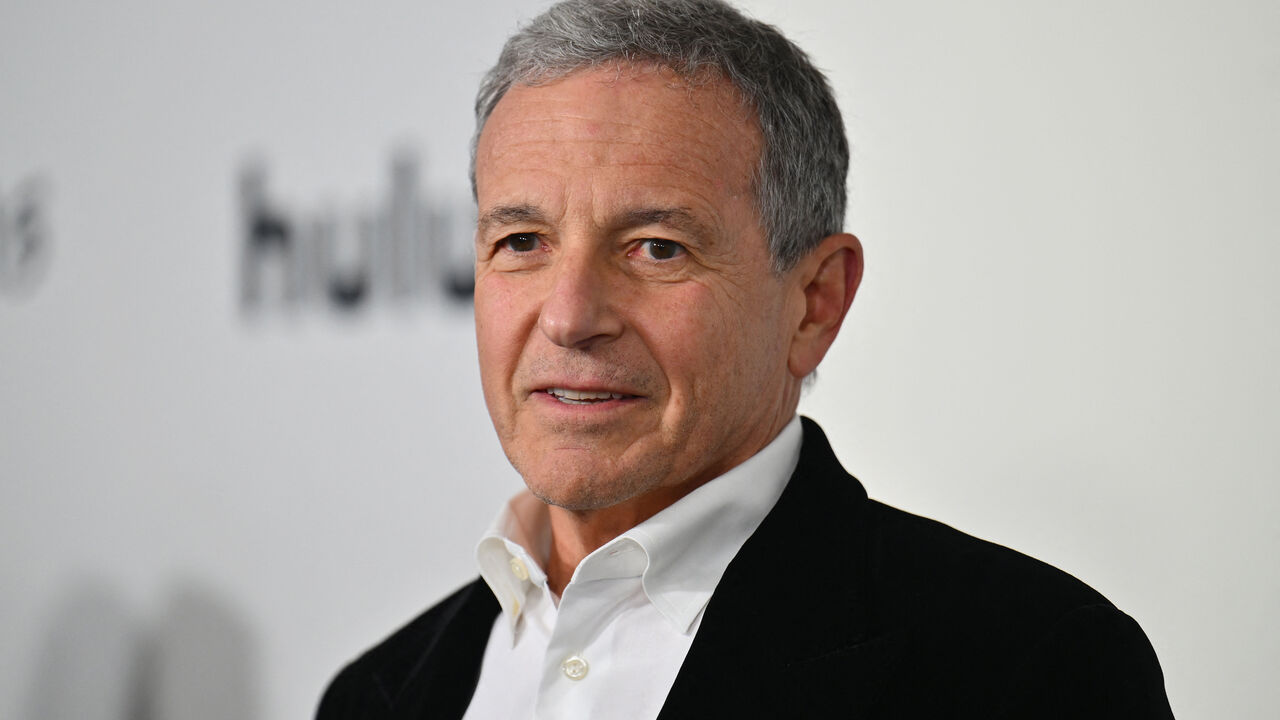

“We’ve been saying for a long time that taking ESPN in the direct-to-consumer direction was inevitable and that we were looking for partners to do so,” Disney CEO Bob Iger said on Wednesday’s earnings call. “The first step was launching ESPN+ some years ago, which has actually been quite successful. The second step is finding these partners to distribute basically the equivalent of a multichannel sports-centric tier via app.

“And that’s a big step for us because we know that there are a number of people who have never signed up for multichannel television. This gives them a chance to do so at a price point that will be obviously more attractive” than the old cable bundle.

One big question yet to be answered: how much are sports keeping the bundle afloat?

At its peak in 2010, cable enjoyed 105 million subscribers in the U.S. before falling to 65.9 million early this year, according to IBISWorld market research. Interestingly, sports ratings remain stable despite the decline. NFL viewership numbers grew this season.

It seems most of the viewership loss is not with sports fans but with those leaving for entertainment programs on Netflix, YouTube, and Disney+.

The problem for the sports business is that those departed consumers were paying sports programming fees that were hidden within their cable bundles. That was the economic power of the cable bundle: everyone paid for everything whether they watched it or not.

What happens when most of the national live sports content on linear cable today becomes available to stream later this year?

“We wouldn’t launch this product if we thought it would significantly impact our pay-TV partners (cable distributors),” FOX CEO Lachlan Murdoch said on his earnings call. “That’s very important to us. We remain, I think, the biggest supporters of the traditional pay-TV bundle.”

Alex Morris of TSOH Investment Research said “it’s a pretty tight window that they are trying to slide into” by ramping up a streaming offering without significantly affecting the cable business. Sports rights are expensive and packaging them in a smaller targeted bundle won’t necessarily reduce the cost to the consumer.

“They seem to think this is going to be targeted at cord-cutters and cord-nevers,” Morris said. “If Murdoch’s view of the world is correct, you have to worry about it less.

“I am curious to see if it can attract a meaningful number of people. The other risk they are going to run, to the extent they get aggressive on the pricing and don’t build in a reasonable amount of gross margin, is going to be cannibalizing their remaining linear bundle.”

The potential cannibalization of cable subs – or continued cable losses – matters because the economics of the cable business are still much stronger than streaming despite their trending decline.

For instance, Morris said Disney earned $17 per cable subscriber per month in the U.S. last quarter for its ESPN cable channels. That compares to $5.50 a month for ESPN+, with many of those subs discounted and connected to Disney+ bundles.

There are some 66 million paid cable users in the U.S. compared to 26 million ESPN+ subscriptions. That means traditional ESPN channels generated $1.1 billion per month from traditional cable users, compared to about $143 million from ESPN+.

(Like many companies, Disney’s streaming business is not yet profitable, though it hopes it will be by the end of 2024.)

In a hypothetical world where cable ceases to exist tomorrow, a standalone ESPN app at a reported $30 per subscription would require 37 million subscriptions to replace cable’s current revenue. Thirty-seven million subs represent more than half the paid cable audience today. Are there that many sports fans willing to pay?

Pew Research published polling data Feb. 5 based on interviews with a representative sample of 12,000 U.S. adults last August and found few Americans consider themselves serious sports fans. In the poll, 62% of American adults said they didn’t follow pro or college sports closely or at all; 21% were casual fans and 16% were avid fans.

How many fans need to be captured in the new streaming world to sustain something similar to today’s economics?

The initial reaction to the ESPN-Fox-WBD deal was positive. Disney stock rose 12% after its earnings report, perhaps in part a response to the plan.

MLB commissioner Rob Manfred, who’s in business with all three networks, called the new platform a “positive.”

“It’s another place that’s going to need to buy rights to make the platform go and be compelling,” he told reporters this week. “It’s particularly good for us. They are our three biggest partners.”

For the most part, those three networks deal only in national broadcast rights, doling out the biggest dollars for the games with the largest audiences. The regional landscape is even more challenging – and where leagues like MLB are more exposed.

The Amazon (partial) bailout

A few weeks ago, Diamond Sports seemed to be coming to grips with its demise because its massive $8-billion debt made it particularly susceptible to cord-cutting dynamics. Diamond, which operates as the Bally Sports regional networks, had reached agreements with the NBA and NHL to wind down operations at the end of the current seasons and to return broadcast rights to the clubs. It began similar talks with MLB teams.

But last month, Amazon came to the rescue – maybe.

Amazon stepped in and offered a cash infusion of $115 million for a 15% stake in Diamond as Diamond attempts to reorganize during its bankruptcy proceedings.

If the bankruptcy deal becomes official, consumers will be able to purchase and watch teams that Diamond holds streaming rights for via Amazon Prime Video. Diamond only holds streaming rights for five of its 12 MLB partners but holds streaming rights for all of its NBA and NHL teams.

Instead of shutting down operations, Diamond’s now trying to survive.

After striking the Amazon deal, Diamond reached one-year deals with three MLB partner clubs that were in limbo: the Rangers, Guardians, and Twins. It plans to honor the terms of the existing contracts of its nine other MLB clubs, which run for varying lengths beyond this season. There’s doubt among industry and league executives about whether Diamond can do that.

“Anything dependent upon the linear bundle sustaining the economics is in doubt until we see a change in trend,” Morris said.

What’s perhaps more interesting is how Amazon sees itself in the live sports TV landscape moving forward. Does Amazon believe it’s simply a distributor, preferring to take a cut of subscriptions purchased on its platform? Or is Amazon eyeing more content ownership? It’s secured exclusive rights to Thursday Night Football, select Yankees games, and some soccer rights in Europe.

“I think Amazon has come to the point where they are becoming less interested in taking really big swings at things, and in an intelligent way. I’m not knocking them,” Morris said. “I think Amazon is thinking, ‘We are in a position here where we can find a solution that may solve a problem for RSNs and digital super fans of local teams without having to take ownership and directly incur the risk of people in a given market paying $30 a month for this RSN DTC service.’

“They are more of a distributor.”

Diamond hopes Amazon Prime Video, with much wider distribution – an estimated 167 million subscribers – and better technology, will help drive subscriptions.

Diamond’s own direct-to-consumer efforts have fallen flat.

It was reported in August that Diamond had 203,000 total digital signups spread across the 29 NBA, MLB, and NHL teams it holds streaming rights for. That’s 7,000 subs per team for packages that cost about $20 a month.

Even as cable subs deteriorate, few have been willing to sign up for RSN standalone apps. When Diamond reneged on its deal last season with the San Diego Padres, only about 18,000 subscribers opted to join its streaming option via MLB.TV.

The uncertainty of running a DTC product is a major reason why teams want to avoid having to launch their own, Bouris said. They’d much rather find a way to recreate the guaranteed revenue and distribution of cable.

Would a tech giant be willing to do that for regional rights?

Bouris believes if Amazon could reach a deal where blackout restrictions ended and RSN broadcast and streaming rights were less fragmented, it could be plausible.

Amazon and other tech giants like Apple and Alphabet (which owns YouTube) have stronger balance sheets to bid on live sports rights. Amazon and YouTube are already in business with the NFL and bidding on national rights packages for the NBA is coming up in 2025. They also have better tech to run streaming services. Perhaps those are reasons why ESPN, FOX, and Warner Bros. banded together: to help spread the costs and access to such rights and tech.

“Content is king. Having access to the content and or owning the content is what you want,” Bouris said. “You attract subscriptions, eyes, sponsors.”

Today, the landscape remains fragmented. But for sports fans, their decisions about where they spend – and what they watch – will ultimately begin to provide answers and shape what comes next.

What we know for certain: change is picking up speed.

Travis Sawchik is theScore’s senior baseball writer.